Many people spend years preparing for retirement by saving and investing, but planning shouldn’t stop once the paychecks do. Transitioning from earning income to withdrawing it from your portfolio is a major shift with a new set of risks and decisions. This period, known as the distribution phase, requires careful thought. How much you withdraw each year can have a bigger impact on long-term financial security than many people realize. Without a well-structured strategy, even a sizable retirement account can be depleted faster than expected.

At Fairvoy, our team can help you plan for your distribution phase of your retirement. We have access to planning tools to help determine a long-term investment and withdrawal strategy to for your portfolio.

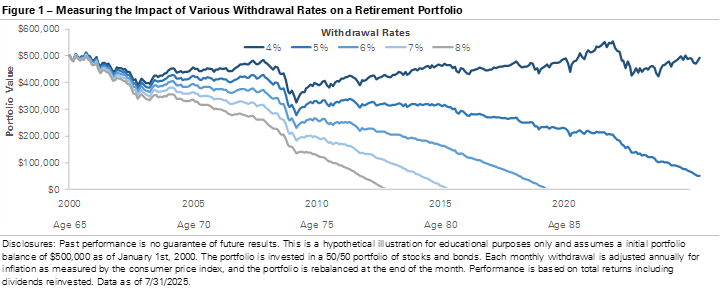

Impact of Various Withdrawals Rates on a Portfolio

The chart below shows how different withdrawal rates can impact a retirement portfolio’s lifespan. It assumes an individual retired in 2000 at age 65 with $500,000 and started taking monthly withdrawals. Each line reflects a different withdrawal rate between 4% and 8%, showing how the portfolio fared through age 85. While all scenarios start at the same point, the paths quickly diverge, especially during periods of market volatility. The chart illustrates how a retiree’s withdrawal strategy can determine whether the portfolio lasts or runs out.

The message is clear: higher withdrawal rates tend to exhaust a portfolio sooner, while lower rates can extend its life. In this example, withdrawing 7% or 8% caused the portfolio to run out of money before age 85. In contrast, the 4% and 5% withdrawal rates helped the portfolio weather market declines. The 4% strategy not only preserved the portfolio but grew it over 20 years, showing how compounding can work even during retirement. No strategy can eliminate market risk, but a smaller withdrawal rate can extend the portfolio’s life and reduce the risk of outliving your savings. Taking a more conservative approach in the early years of retirement gives your portfolio time to recover from short-term losses and grow with the market.

What Withdrawal Percentage if Right for Me?

A thoughtful withdrawal strategy is an important part of retirement planning. It’s not just about how much you’ve accumulated, but how you manage it. There’s no one-size-fits-all approach, and the method you start with doesn’t have to be permanent. Fixed withdrawal rates can provide a good starting point, but many retirees may benefit from more flexible approaches.

For example, you could adjust withdrawals based on market conditions, taking smaller distributions in down years and larger ones in strong years. Another option is the bucket strategy, which divides assets into short-, intermediate-, and long-term segments. By keeping a few years’ worth of expenses in cash or short-term investments, you can avoid selling stocks during major market declines, such as those in 2008 or 2020. This gives long-term investments time to recover and can help create a steadier income stream over time.

Everyone’s retirement looks different. Our goal is to help you create a withdrawal strategy tailored to your unique needs and goals when that time comes.

In Conclusion

Planning for retirement doesn’t end when the paychecks stop. The decisions you make during the distribution phase can determine whether your savings will last a lifetime or fall short when you need them most. That’s where having an experienced partner by your side makes all the difference.

At Fairvoy Private Wealth, we combine advanced planning tools with decades of experience to design withdrawal strategies that are both resilient and tailored to your unique goals. Our team is committed to helping you protect what you’ve worked so hard to build, while giving you confidence in the years ahead.

If you’d like to explore how we can guide you through this important stage of retirement, we invite you to contact us today. Together, we can create a great journey toward financial security and peace of mind.