Monthly Market Update | March 2025

Written By: Fairvoy Private Wealth, LLC.

Contact Us

Monthly Market Summary

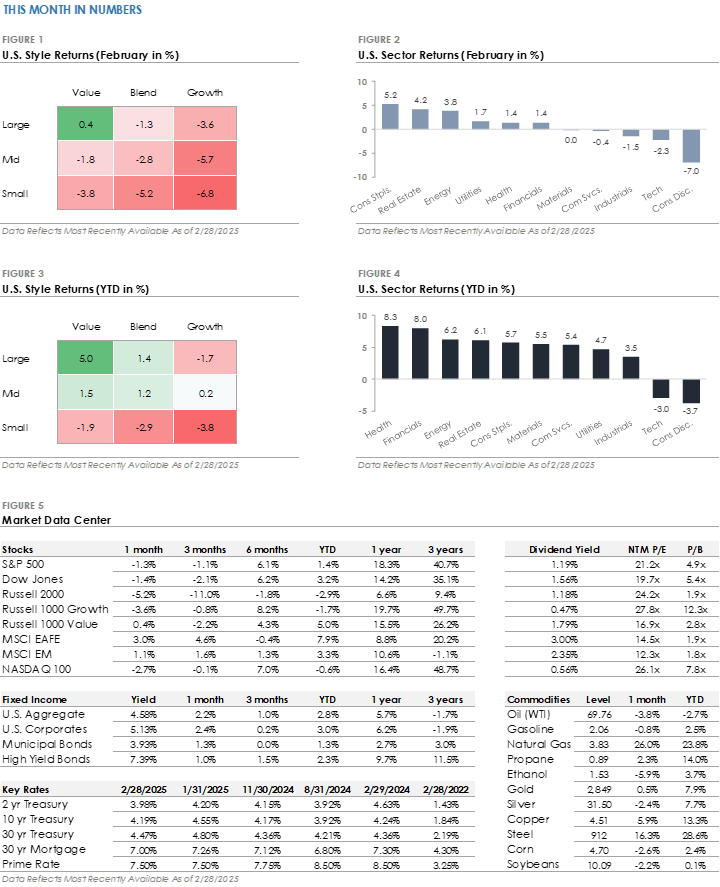

- The S&P 500 Index returned -1.3%, outperforming the Russell 2000 Index’s -5.2% return. Six of the eleven S&P 500 sectors traded higher, led by defensive sectors.

- Bonds traded higher, with the U.S. Bond Aggregate delivering a +2.2% total return. Corporate investment-grade bonds produced a +2.4% total return as Treasury yields declined, outperforming corporate high-yield’s +1.0% total return.

- International stocks traded higher and outperformed the S&P 500. Developed Markets gained +3.0%, led by Europe, while Emerging Markets returned +1.1%.

- Expect continued volatility and downward pressure until tariffs and spending cut impacts on the economy are resolved.

Stocks and Bonds Move in Opposite Directions Amid Market Rotation

Stocks traded lower in a late-month sell-off as sentiment weakened. The S&P 500’s decline erased most of its post-election gains, which had been driven by expectations for stronger growth and deregulation under the new administration. Smaller companies underperformed, with the Russell 2000 ending the month more than -10% below its late November peak. Beneath the surface, the January market rotation continued as last year’s outperformers lagged. The Magnificent 7, a group of mega-cap tech stocks that drove most of 2024’s gains, fell by -8% and dragged down the Nasdaq 100, the Large Cap Growth factor, and the S&P 500. In contrast, defensive sectors and international stocks traded higher, while gold set a new all-time high. In the bond market, Treasury yields declined, with the 10-year yield falling to its lowest level since early December. The decline in interest rates caused bonds to rise, partially offsetting the stock market sell-off.

Economic Growth Holds Steady, but Market Reacts to High Expectations

The sell-off wasn’t triggered by a single event or data point but by a combination of interconnected factors. Economic reports underperformed expectations and revealed a cooling U.S. economy, as the services sector contracted, and consumer confidence deteriorated. The combination signaled slowing consumer demand, a key pillar of economic growth during recent years. In Washington, policy uncertainty remained high, with renewed tariff threats against key trading partners and DOGE spending cuts. The market’s primary concern: imposing tariffs and reducing government spending could slow economic growth. In the stock market, Nvidia’s highly anticipated earnings report failed to reignite enthusiasm for AI companies, leading to a broader sell-off in technology stocks.

Market Sentiment Shifts from Growth to Caution in February

Following the election, the market initially focused on the incoming administration’s pro-growth policies. Expectations for tax cuts, deregulation, and increased energy production fueled hopes for stronger U.S. economic growth. At the start of the year, investors were optimistic about a “Goldilocks” scenario—moderate growth, cooling inflation, and lower interest rates. The optimism propelled stocks to new record highs this year, but with economic and policy uncertainty building, investor sentiment has become more cautious. The focus has now shifted from solid earnings growth and a robust labor market to concerns about slowing economic growth and uncertain government policy.

Market Expectations in the Near Term

The S&P 500 remains in a long-term uptrend but is currently experiencing near-term oversold conditions, reflecting ongoing market uncertainty. While the index is down more than 5% from its recent high, a deeper correction—potentially reaching 10%—would not be unusual given historical market patterns. Periods of sharp rebounds may be followed by further pullbacks as investors react to evolving economic conditions, including tariff negotiations, government spending policies, and broader economic data. Until there is greater clarity on these issues, volatility is likely to persist.

Looking ahead, the market’s direction will largely depend on policy developments. If the administration successfully secures favorable trade concessions and implements meaningful spending cuts, investor sentiment could improve, potentially driving the market higher later this year. On the other hand, prolonged uncertainty or unfavorable outcomes in these areas could weigh on growth expectations. While short-term fluctuations may continue, long-term investors should remain focused on broader trends rather than reacting to temporary market swings.