Comprehensive Financial Planning

A written plan that connects the dots across your financial life.

At Fairvoy, comprehensive planning is an ongoing process – not a one-time report. We help you set priorities, build a strategy, and keep decisions aligned as markets and life change. Our team includes CFP professionals and Chartered Retirement Planning Counselors, and we bring a practical, client-friendly approach.

Quick highlights

A strong plan helps you make better decisions – especially when markets are noisy.

What makes a plan truly comprehensive?

Holistic view: We consider how investments, debt, taxes, insurance, and estate planning affect each other.

Integrated strategy: Decisions in one area should support goals in another (and avoid conflicts).

Long-term focus: A written plan that evolves through market cycles and life events.

Personalized: Tailored recommendations based on your goals, risk comfort, and family priorities.

Know what matters most

We help you prioritize goals so decisions feel less overwhelming and more intentional.

Connect the moving parts

Cash flow, taxes, investments, and retirement income should work together – not separately.

Adjust as life changes

The best plans are reviewed and updated as markets, tax rules, and priorities change.

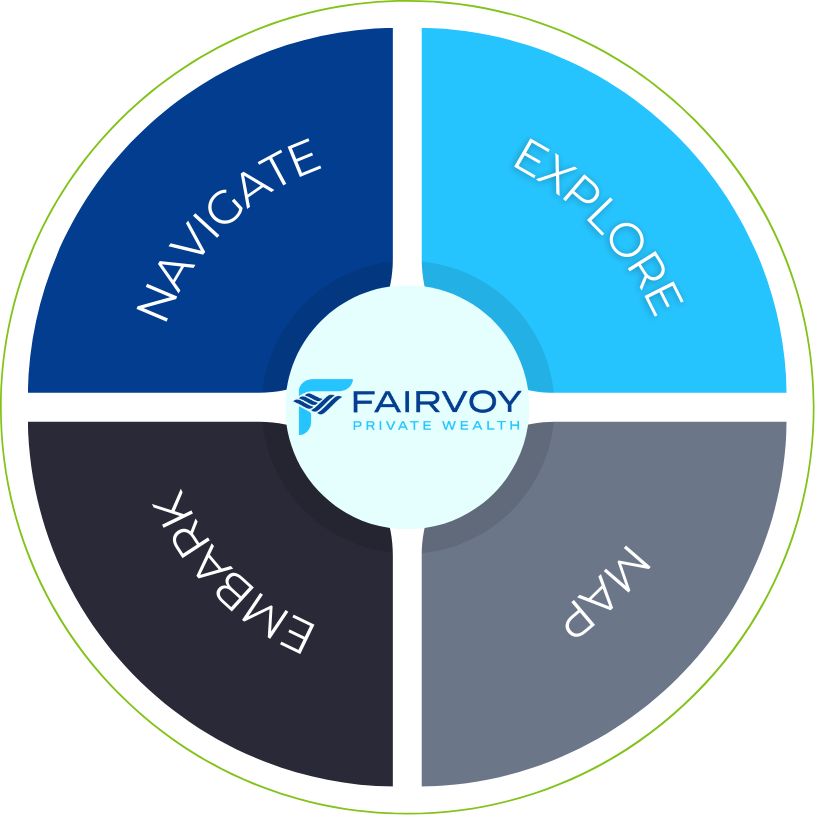

Our planning process

We keep the process organized and easy to follow. The goal is to provide clarity, then action, then ongoing direction.

1) Explore the Vision

We learn what matters most: lifestyle goals, family priorities, and what you want your money to do for you.

2) Map the Journey

We organize accounts, review cash flow, evaluate risks, and identify planning opportunities across your financial life.

3) Embark on the Voyage

We put the strategy into motion: investments, savings systems, retirement contributions, insurance decisions, and other steps.

4) Ongoing Navigation

Markets and life change. We monitor progress and adjust recommendations to keep you on track.

Planning in one view

These visuals are intentionally simple – they illustrate how different planning areas support your goals.

The planning wheel

Everything revolves around your priorities – then we coordinate the moving parts to support them.

Risk and return – simplified

We build portfolios to match your time horizon and comfort level – and coordinate that with retirement income and cash flow needs.

Key areas we cover

Comprehensive planning typically includes the topics below. The emphasis depends on your goals and stage of life.

Goal setting

Identify and prioritize short- and long-term goals (retirement, education, major purchases, charitable giving) and set measurable targets.

Cash flow and budgeting

Understand where money is coming from and going, create a savings plan, and build flexibility for life events.

Investment planning

Develop a diversified portfolio aligned with your risk tolerance, time horizon, and goals – and keep it disciplined over time.

Risk management and insurance

Evaluate health, disability, life, liability, and property coverage to help protect the plan from the unexpected.

Tax planning coordination

Coordinate decisions across accounts and income sources with tax awareness (with your CPA as needed).

Retirement planning

Build strategies for saving, timing retirement, and creating retirement income that supports your lifestyle.

Estate planning and legacy

Organize beneficiary designations and coordinate with your attorney on wills, trusts, and wealth transfer decisions.

Ongoing monitoring

Review progress, update assumptions, and make course corrections as markets, tax rules, and priorities change.

What to expect when we build your plan

We keep the first steps simple. If you do not have everything, we can still start – and fill in details over time.

Statements and income picture

Accounts, benefits, and a high-level view of household income and spending.

Goals, concerns, and tradeoffs

What do you want money to do? What keeps you up at night?

Clear next steps

We convert recommendations into a practical checklist and keep it updated.

Financial planning FAQs

Common questions we hear from consumers considering a financial advisor.

- CFP Board, Guide to the Financial Planning Process (2022). https://www.cfp.net/ethics/compliance-resources/2022/01/guide-to-the-financial-planning-process

- SEC Investor.gov, Financial Planners (glossary). https://www.investor.gov/introduction-investing/investing-basics/glossary/financial-planners

- IRS, Required Minimum Distributions FAQs. https://www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs

- FINRA, Investing Basics. https://www.finra.org/investors/investing/investing-basics

- SEC, Saving and Investing: A Roadmap to Your Financial Security (PDF). https://www.sec.gov/investor/pubs/sec-guide-to-savings-and-investing.pdf