Written by: Stephen Davis, CFP®, ChFC®, APMA®

Managing Partner, Senior Private Wealth Advisor

Published September 9, 2025

Turning 50 can bring a mix of pride in life’s accomplishments and anxiety about what’s ahead, especially when it comes to retirement. Many people in their early 50s find themselves juggling college expenses for their kids, aging parents who may need care, and the growing realization that retirement isn’t as far off as it once seemed. It’s common at this stage to feel like you’re behind on saving, especially if earlier years were focused on family, business, or simply making ends meet. But the good news is this: with focus, discipline, and smart planning, the years between 50 and 65 can become the most powerful savings window of your life.

Why Your 50s Can Be a Powerful Savings Window

While starting earlier is ideal, what often gets overlooked is how impactful the final 15 years before retirement can be. This is especially true when taking advantage of higher contribution limits, catch-up provisions, and the compounding effect of market growth. At age 50, many individuals are entering their peak earning years and may have fewer financial obligations than in earlier decades. The IRS also allows increased contributions to retirement accounts starting at this age. With a clear plan and consistent savings, it is possible to build significant retirement assets, even if you feel behind. Let’s explore what that might look like in practice.

According to Fidelity’s Q4 2024 401(k) data*, the average 401(k) balance for individuals aged 50 to 54 is approximately $199,900. While that may seem like a substantial amount, it often falls short of where many people need to be to maintain their desired lifestyle in retirement. If you’re 50 and looking at a 401(k) with around $200,000 saved, you’re far from alone. The good news is that this balance can still grow significantly over the next 15 years with consistent saving, the use of catch-up contributions, and disciplined investing.

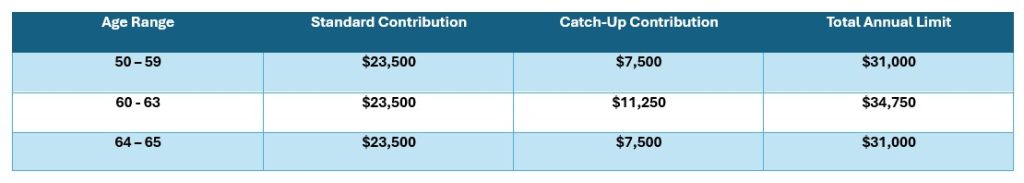

Once you turn 50, the IRS gives you the opportunity to contribute more to your 401(k) than ever before through what are known as catch-up contributions. The table below shows how much you can contribute each year starting at age 50, including the enhanced catch-up amounts available between ages 60 and 63, recently expanded under the SECURE 2.0 Act.

Not everyone can contribute the maximum, and that is completely understandable. Life at 50 can involve a variety of financial obligations, including supporting children, helping aging parents, or paying down debt. Still, this is a crucial time to review your budget and contribute what you can. These years often represent peak earnings and fewer major expenses compared to earlier decades. Even small increases in savings can make a noticeable difference. The most important thing is to stay consistent.

What Focused Saving Can Achieve

To illustrate the potential impact of focused saving in the years leading up to retirement, let’s look at a hypothetical example. We will assume an individual is 50 years old with a current 401(k) balance of $199,900, which reflects the national average for this age group based on recent Fidelity data. From this point forward, we will assume annual contributions are made at the maximum allowed levels, including the appropriate catch-up amounts starting at age 50 and increasing at age 60 as permitted under current IRS rules. We will also assume a consistent annual return of 7 percent, which could reflect a moderate long-term growth rate in a diversified investment portfolio. While actual investment results will vary year to year, this provides a framework to understand how savings can grow over a 15-year period through age 65.

Full Contribution Example

Starting at age 50 with a 401(k) balance of $199,900 and consistently contributing the maximum annual amount allowed under current IRS guidelines, an individual could grow their retirement account to approximately $1.4 million by age 65. Even without any employer match, the combination of disciplined saving and compound growth over this 15-year period demonstrates the significant potential to close a retirement savings gap. While individual results will vary based on market performance and personal circumstances, this example reinforces the importance of using the final working years to save strategically and with purpose.

Half Contribution Example

For those who are unable to contribute the full IRS maximum, the numbers still offer encouraging news. In this scenario, we assume the individual contributes half of the allowable limit each year, beginning with $15,500 at age 50 and increasing in line with the enhanced catch-up provisions starting at age 60. With the same starting balance of $199,900 and a 7 percent annual return, the account still grows to approximately $1 million by age 65. While this is lower than the result from maxing out contributions, it still represents impressive progress. This reinforces that steady contributions, even at reduced levels, can lead to a meaningful and workable retirement balance over time.

Comparing the Results

By age 65, the difference between contributing the full amount and contributing half adds up to approximately $441,800. The full contribution strategy results in an account value of about $1,473,730, while “half” contribution path reaches around $1,031,934. This gap shows just how powerful consistent, maximum savings can be during your final working years. However, it also reinforces that contributing even half the allowable amount can still produce a seven-figure retirement balance. Whether you are able to contribute more or less, the most important step is getting started and staying consistent. In both cases, your saving will be well ahead of the average 401(k) balance of a 65-year-old, at $251,400 (Source: Fidelity Investments Q4, 2024)

| Age (Year End) | Full Contribution Balance | Half Contribution Balance |

| 50 | $240,000 | $228,000 |

| 55 | $520,000 | $410,000 |

| 60 | $912,000 | $665,000 |

| 65 | $1,471,000 | $1,029,000 |

This table shows the projected growth of a 401(k)-account starting at $199,000 at age 50, assuming a hypothetical 7% annual return. Two scenarios are compared: contributing the full IRS maximum plus catch-up amounts, and contributing half of that each year, through the end of age 65. It is for educational purposes only and does not guarantee future results. See important disclosures at the end of this article.

Making the Most of Your Options

It is important to note that the projections above do not include any potential employer matching contributions, which can significantly boost your retirement savings over time. In addition to how much you contribute, it is also important to consider how you contribute. You may have the option to use a traditional 401(k), which defers taxes until retirement, or a Roth 401(k), which uses after-tax dollars and provides tax-free withdrawals later. The right choice depends on your current income, tax outlook, and future needs. Outside of your employer plan, traditional and Roth IRAs may offer additional opportunities to save, though eligibility depends on factors such as income and whether you already participate in a workplace plan. Understanding how these tools work together can help you build a more effective and tax-efficient retirement strategy. Contact our team at Fairvoy Private Wealth for more assistance.

How Fairvoy Can Help

At Fairvoy Private Wealth, we understand that the years between 50 and 65 are among the most important for building your retirement foundation. Whether you feel behind or just want to maximize the years ahead, we can help you evaluate your current position, model different savings strategies, and create a plan that aligns with your goals. From determining how much to contribute to deciding between pre-tax and Roth options, our team can guide you through the decisions that will shape your future. These years matter, and your future self will thank you for the commitment.